After spending much time developing this new stock scanner/filter, "S-Trader Channel Break Out", and several test trials on different stock markets to verify its performance.

Here is a sample of recent scan result on SGX market based on last Friday 21 Oct 2016 closing price.

Let's monitor for next few days how those stocks filtered perform.

Wednesday, 26 October 2016

Sunday, 17 July 2016

WTI Crude Oil - Case Study

(Published on 17 July 2016, Re-published on 18 July 2016)

I have been following crude oil price for some time. However, recent price action got my full attention.

Here is a chart example of West Texas Intermediate (WTI) Crude Oil.

On 16 Jun 2016, the price broke below the S-Trader Pivot Support but the price action did not move downward aggressively as some of the indicators as noted below did not show heavy selling pressure in much action.

1) S-Trader Volumetric - relatively below Average volume.

2) S-Trader Smart Money Index - Positive (Green bar), big boys are still supporting the market. But, there is sign of declining support.

3) S-Trader Multi Months High Low - 1-month Low triggered.

Similar situation occurred on 27 Jun except this time S-Trader Volumetric showed relatively Average volume.

On 7 Jul, it had a similar outcome with 27 Jun except S-Trader Smart Money Index at lowest positive side as compare to 2 previous events.

The following day 8 Jul and onwards Smart Money Index showed the big boys has moved toward the negative side (Red bar) while price action on side way.

Going forward, its quite interesting to watch the price direction.

In fact, the situation has becomes more exciting with some of the following news been published.

5 July 2016 - "Chevron Bets $37 Billion on Expansion as Oil Rises, Costs Fall"

7 July 2016 - "Big Oil's $45 Billion of New Projects Signal Spending Revival"

12 July 2016 - "OPEC Producer Sees Oil at $60 Until 2018 With Demand Picking Up"

15 July 2016 - "Faltering Oil Recovery Prompts Warnings of a Relapse to $40"

Chart Source :

1) Metastock

I have been following crude oil price for some time. However, recent price action got my full attention.

Here is a chart example of West Texas Intermediate (WTI) Crude Oil.

On 16 Jun 2016, the price broke below the S-Trader Pivot Support but the price action did not move downward aggressively as some of the indicators as noted below did not show heavy selling pressure in much action.

1) S-Trader Volumetric - relatively below Average volume.

2) S-Trader Smart Money Index - Positive (Green bar), big boys are still supporting the market. But, there is sign of declining support.

3) S-Trader Multi Months High Low - 1-month Low triggered.

Similar situation occurred on 27 Jun except this time S-Trader Volumetric showed relatively Average volume.

On 7 Jul, it had a similar outcome with 27 Jun except S-Trader Smart Money Index at lowest positive side as compare to 2 previous events.

The following day 8 Jul and onwards Smart Money Index showed the big boys has moved toward the negative side (Red bar) while price action on side way.

Going forward, its quite interesting to watch the price direction.

In fact, the situation has becomes more exciting with some of the following news been published.

5 July 2016 - "Chevron Bets $37 Billion on Expansion as Oil Rises, Costs Fall"

7 July 2016 - "Big Oil's $45 Billion of New Projects Signal Spending Revival"

12 July 2016 - "OPEC Producer Sees Oil at $60 Until 2018 With Demand Picking Up"

15 July 2016 - "Faltering Oil Recovery Prompts Warnings of a Relapse to $40"

Chart Source :

1) Metastock

Wednesday, 13 July 2016

CNMC Goldmine Holdings Ltd (STI : CNMC) - Case Study

CNMC also joined the gold price rally.

On 10 February 2016, CNMC breakout S-Trader Pivot Resistance and closed at SGD 0.20707. With the following indications been triggered.

1) S-Trader Smart Money Index - Positive, the big boys turned bullish.

2) S-Trader Multi Months High Low - 1-month High breakout.

3) S-Trader Volumetric - relatively High volume.

The following day, 11 February CNMC continued its rally and setting some indicators new record.

1) S-Trader Multi Months High Low - 1st 3-month High breakout.

2) S-Trader Volumetric - relative Very High/or Ultra High volume.

The stock price rallied to a closing of SGD 0.61 on 7 July 2016 with a profit of SGD 0.40293 (+194.6%).

If we miss the first opportunity, the next good entry happened on 20 April 2016 with a closing price of SGD 0.25637.

CNMC breakout S-Trader Pivot Resistance with strong support from big boys (S-Trader Smart Money Index - Positive or Green bar) along with relatively Very High/or Ultra High volume.

This 2nd opportunity also works a handsome profit of SGD 0.35363 (+138%).

Chart Source :

1) Metastock

On 10 February 2016, CNMC breakout S-Trader Pivot Resistance and closed at SGD 0.20707. With the following indications been triggered.

1) S-Trader Smart Money Index - Positive, the big boys turned bullish.

2) S-Trader Multi Months High Low - 1-month High breakout.

3) S-Trader Volumetric - relatively High volume.

The following day, 11 February CNMC continued its rally and setting some indicators new record.

1) S-Trader Multi Months High Low - 1st 3-month High breakout.

2) S-Trader Volumetric - relative Very High/or Ultra High volume.

The stock price rallied to a closing of SGD 0.61 on 7 July 2016 with a profit of SGD 0.40293 (+194.6%).

If we miss the first opportunity, the next good entry happened on 20 April 2016 with a closing price of SGD 0.25637.

CNMC breakout S-Trader Pivot Resistance with strong support from big boys (S-Trader Smart Money Index - Positive or Green bar) along with relatively Very High/or Ultra High volume.

This 2nd opportunity also works a handsome profit of SGD 0.35363 (+138%).

Chart Source :

1) Metastock

Monday, 11 July 2016

Shandong Gold Mining Co. Ltd (SSE Composite) - Case Study

Here is another example of stock price rallies in tandem with gold rally.

On 24 February 2016, the stock price broke above S-Trader Pivot Resistance with closing price of RMB24.41.

The price broke out with the following indications.

1) S-Trader Smart Money Index - Positive (Green Bar). This indicates strong support from Big Boys (Smart Money).

2) S-Trader Multi Months High Low - 1st 6-month High breakout.

3) S-Trader Volumetric - relatively High volume.

Thereafter, the stock price rallied with the latest closing price of RMB46.56 on 8 July 2016. A profit of RMB22.15 (+90.7%).

Chart Source :

1) Metastock

On 24 February 2016, the stock price broke above S-Trader Pivot Resistance with closing price of RMB24.41.

The price broke out with the following indications.

1) S-Trader Smart Money Index - Positive (Green Bar). This indicates strong support from Big Boys (Smart Money).

2) S-Trader Multi Months High Low - 1st 6-month High breakout.

3) S-Trader Volumetric - relatively High volume.

Thereafter, the stock price rallied with the latest closing price of RMB46.56 on 8 July 2016. A profit of RMB22.15 (+90.7%).

Chart Source :

1) Metastock

Sunday, 10 July 2016

Barrick Gold Corporation (NYSE : ABX) - Case Study

Gold price rebounds on early January 2016 from its bottom.

Similarly, ABX also rebounds around the same period.

Prior to that, ABX had been moving in the sideway market for certain periods, as shown in the chart below.

In side way market, the price action only able to hit 1-month High or Low several times. Despite breaking the 1-month High, the stock did not rally much.

The first breakthrough came on 7 January 2016 (point #1) with the following indications on S-Trader.

1) Price broke above the S-Trader Pivot Resistance

2) Price action hits 3-month High.

3) S-Trader Volumetric recorded relatively High volume action.

4) S-Trader Smart Money Index showed the Big Boys (Smart Money) supporting the price breakout.

However, the price action did not move any much further.

In fact, the price pullback but supported by S-Trader Pivot Support. At the same time, smart money still in the market supporting it (as shown by S-Trader Smart Money Index - green bar).

On 25 January 2016 (point #2), once again the price made another breakout with the similar indications on S-Trader but this time it hits 6-month High.

Chart Source :

1) goldprice.org

2) Metastock

Similarly, ABX also rebounds around the same period.

Prior to that, ABX had been moving in the sideway market for certain periods, as shown in the chart below.

In side way market, the price action only able to hit 1-month High or Low several times. Despite breaking the 1-month High, the stock did not rally much.

The first breakthrough came on 7 January 2016 (point #1) with the following indications on S-Trader.

1) Price broke above the S-Trader Pivot Resistance

2) Price action hits 3-month High.

3) S-Trader Volumetric recorded relatively High volume action.

4) S-Trader Smart Money Index showed the Big Boys (Smart Money) supporting the price breakout.

However, the price action did not move any much further.

In fact, the price pullback but supported by S-Trader Pivot Support. At the same time, smart money still in the market supporting it (as shown by S-Trader Smart Money Index - green bar).

On 25 January 2016 (point #2), once again the price made another breakout with the similar indications on S-Trader but this time it hits 6-month High.

Chart Source :

1) goldprice.org

2) Metastock

Monday, 4 July 2016

What's Next : S-Trader Trading System

To date, I have briefly introduced some of my personal custom indicators as noted below. All this indicators have been developed using Metastock Formula Language.

1) S-Trader Pivot Support and Resistance

2) S-Trader Volumetric

3) S-Trader Smart Money Index

4) S-Trader Multi Month High Low

5) S-Trader Multi Year High Low

Going forward, I will be using this indicators to analyse stocks from various markets such as US, Hong Kong, Singapore and others. If there is any appropriate indicators to further enhance our analysis available within metastock software will be used together with S-Trader Trading System.

Also, more details on the use of this indicators will be shared in the analysis.

Stay Tuned.

1) S-Trader Pivot Support and Resistance

2) S-Trader Volumetric

3) S-Trader Smart Money Index

4) S-Trader Multi Month High Low

5) S-Trader Multi Year High Low

Going forward, I will be using this indicators to analyse stocks from various markets such as US, Hong Kong, Singapore and others. If there is any appropriate indicators to further enhance our analysis available within metastock software will be used together with S-Trader Trading System.

Also, more details on the use of this indicators will be shared in the analysis.

Stay Tuned.

Saturday, 2 July 2016

S-Trader Pivot Support and Resistance : Introduction

Under Metastock's Expert Advisor, there is an interesting trading system which caught my attention. The trading system is known as "Profitunity - Bill Williams".

An example chart with Profitunity - Bill Williams trading system.

Notice those arrows on the chart which indicates the Fractals.

For more details on Fractals, click on the link below.

A Trader's Guide to Using Fractals

A quick glance on the fractal points, one could identify the tops and bottoms of the price movements. However, using the original Fractals presentation on metastock could make the task of analysis challenging for some users.

To make it more presentable, I have developed a custom indicators called "S-Trader Pivot Support" and "S-Trader Pivot Resistance".

An example chart with S-Trader Pivot Support and Resistance.

Basically, the S-Trader Pivot Support and Resistance indicators connect all the top and bottom Fractals accordingly forming sort of price movement channels.

With it, we could use it to identify price break out.

Chart Source :

1) Metastock

An example chart with Profitunity - Bill Williams trading system.

Notice those arrows on the chart which indicates the Fractals.

For more details on Fractals, click on the link below.

A Trader's Guide to Using Fractals

A quick glance on the fractal points, one could identify the tops and bottoms of the price movements. However, using the original Fractals presentation on metastock could make the task of analysis challenging for some users.

To make it more presentable, I have developed a custom indicators called "S-Trader Pivot Support" and "S-Trader Pivot Resistance".

An example chart with S-Trader Pivot Support and Resistance.

Basically, the S-Trader Pivot Support and Resistance indicators connect all the top and bottom Fractals accordingly forming sort of price movement channels.

With it, we could use it to identify price break out.

Chart Source :

1) Metastock

Friday, 1 July 2016

S-Trader Smart Money Index : Introduction

When traders/investors place their money on stocks/indices/commodities, their main concern is whether they are on the right side of the market.

If we are able to address the following questions, it will be a great advantageous to the retail traders/investors where they could ride along with the smart money's wave.

1) Who are the smart money ?

2) When are they investing ?

3) Where are they investing ?

With that in mind, I have developed a custom indicator called "S-Trader Smart Money Index".

An example chart :

Chart Source :

1) Metastock

If we are able to address the following questions, it will be a great advantageous to the retail traders/investors where they could ride along with the smart money's wave.

1) Who are the smart money ?

2) When are they investing ?

3) Where are they investing ?

With that in mind, I have developed a custom indicator called "S-Trader Smart Money Index".

An example chart :

Chart Source :

1) Metastock

Thursday, 30 June 2016

S-Trader Volumetric : Introduction

Here I shall introduce a new S-Trader custom indicator called "S-Trader Volumetric".

Extracted from Investopedia website.

"Volume is an important indicator in technical analysis as it is used to measure the relative worth of a market move. If the markets make a strong price movement, then the strength of that movement depends on the volume for that period. The higher the volume during the price move, the more significant the move."

An example chart of Barrick Gold Corp (NYSE : ABX).

From the chart, we can observe those price action that made 3/6/9/12-month High followed with strong volume. (As highlighted by Blue Colour Arrow).

However, it can be quite challenging for some untrained eye to use raw volume to make judegement whether it is average, high or very high/ultra high volume.

S-Trader Volumetric is developed to overcome that matter.

Please take note that the Volumetric is a supplement indicator to the existing Volume indicator and not a replacement.

An example chart is shown below with S-Trader Volumetric.

The table below illustrates the Volumetric representation.

Notice that its much easy for the users to interpret the relative volume using Volumetric. All those volume indicated earlier by the arrow can be shown as High relative volume rather than a subjective expression (such as strong or higher volume).

Chart Source :

1) Metastock

Extracted from Investopedia website.

"Volume is an important indicator in technical analysis as it is used to measure the relative worth of a market move. If the markets make a strong price movement, then the strength of that movement depends on the volume for that period. The higher the volume during the price move, the more significant the move."

An example chart of Barrick Gold Corp (NYSE : ABX).

From the chart, we can observe those price action that made 3/6/9/12-month High followed with strong volume. (As highlighted by Blue Colour Arrow).

However, it can be quite challenging for some untrained eye to use raw volume to make judegement whether it is average, high or very high/ultra high volume.

S-Trader Volumetric is developed to overcome that matter.

Please take note that the Volumetric is a supplement indicator to the existing Volume indicator and not a replacement.

An example chart is shown below with S-Trader Volumetric.

The table below illustrates the Volumetric representation.

Notice that its much easy for the users to interpret the relative volume using Volumetric. All those volume indicated earlier by the arrow can be shown as High relative volume rather than a subjective expression (such as strong or higher volume).

Chart Source :

1) Metastock

Monday, 27 June 2016

S-Trader Multi-Year/Month High Low : Brief Explanation

In the previous posting, I have introduced 2 new custom indicators to complement the 52-week High Low.

I will provide some brief notes on these new custom indicators on values representation.

An example chart of Barrick Gold Corp (NYSE : ABX) with S-Trader Multi Month High Low.

The table below illustrates the Multi Month values representation.

Here is another example chart of Shanghai Composite with S-Trader Multi Year High Low.

The Multi Year values representation as shown in the table below.

Chart Source :

1) Metastock

I will provide some brief notes on these new custom indicators on values representation.

An example chart of Barrick Gold Corp (NYSE : ABX) with S-Trader Multi Month High Low.

The table below illustrates the Multi Month values representation.

Here is another example chart of Shanghai Composite with S-Trader Multi Year High Low.

The Multi Year values representation as shown in the table below.

Chart Source :

1) Metastock

Wednesday, 22 June 2016

52-Week High/Low - Alternative Time Period

In the previous posting, I discovered a huge opportunities missed when one uses the 52-week High/Low strategy especially the market rebounds from its low or reverses from its high prior to hit 52-week High or Low.

I decided to seek an alternative time period to complement the existing strategy.

It's mind boggling when I started this task.

If the extension is too short it will limits the usefulness of it. But if the extension is too wide it will creates more confusion to the traders/investors.

Then I came across a website with some useful information.

Attached below is the snapshot from the website with highlights on the section consists of the info.

(Website source : www.barchart.com)

Under "Percent Advances/Declines", there are set of different time periods. A good references.

With that info, I have created 2 new custom indicators called "S-Trader Multi Month High Low". and "S-Trader Multi Year High Low" to complement "S-Trader 52-week High Low".

The Multi Year will consists of 1-month, 3-month, 6-month, 9-month and 12-month.

As for the Multi Year, it includes the following period: 3-year, 5-year, 7-year and 9-year.

I decided to seek an alternative time period to complement the existing strategy.

It's mind boggling when I started this task.

If the extension is too short it will limits the usefulness of it. But if the extension is too wide it will creates more confusion to the traders/investors.

Then I came across a website with some useful information.

Attached below is the snapshot from the website with highlights on the section consists of the info.

(Website source : www.barchart.com)

Under "Percent Advances/Declines", there are set of different time periods. A good references.

With that info, I have created 2 new custom indicators called "S-Trader Multi Month High Low". and "S-Trader Multi Year High Low" to complement "S-Trader 52-week High Low".

The Multi Year will consists of 1-month, 3-month, 6-month, 9-month and 12-month.

As for the Multi Year, it includes the following period: 3-year, 5-year, 7-year and 9-year.

Sunday, 19 June 2016

52-Week High / Low - Wrap Up

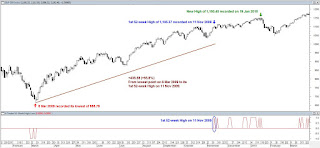

After looking at several indices - Dow Jones Industrial Average (DJIA), S&P500, Hang Seng Index (HSI) and Straits TImes Index (STI), it's quite fascinating to see how this strategy turns out on indices from different regions.

From the look of it, the market actions is quite like what been stated in our earlier blog topic "Introduction - 52-Week High / Low" posted on 7 May 2016.

When the market exceeds its 52-week high or low, it is not necessary the market actions continue it's preceeding direction but it may reverses.

Seeing that, it makes the analysis more challenging if one to use solely this strategy.

We also noticed the huge opportunities miss when one applies this strategy. Take a look at the chart below.

(Posted earlier on 15 May 2016 under "52-Week High Low Case Study - Dow Jones Industrial Average (DJIA)").

During the US Subprime Mortgage Crisis, it made a low of 6,469.95 on 6 March 2009 and the market rebounded to 52-week High of 10,228.20 on 9 Nov 2009.

A total of 3,758.25 points gained from the rebound.

Another example of chart (attached below) with huge points gained from the rebound in comparison to the 52-week High break out.

Big Fat Rabbit !

Huge opportunities not to be missed for long position traders.

Source :

1) Metastock

From the look of it, the market actions is quite like what been stated in our earlier blog topic "Introduction - 52-Week High / Low" posted on 7 May 2016.

When the market exceeds its 52-week high or low, it is not necessary the market actions continue it's preceeding direction but it may reverses.

Seeing that, it makes the analysis more challenging if one to use solely this strategy.

We also noticed the huge opportunities miss when one applies this strategy. Take a look at the chart below.

(Posted earlier on 15 May 2016 under "52-Week High Low Case Study - Dow Jones Industrial Average (DJIA)").

During the US Subprime Mortgage Crisis, it made a low of 6,469.95 on 6 March 2009 and the market rebounded to 52-week High of 10,228.20 on 9 Nov 2009.

A total of 3,758.25 points gained from the rebound.

Another example of chart (attached below) with huge points gained from the rebound in comparison to the 52-week High break out.

Big Fat Rabbit !

Huge opportunities not to be missed for long position traders.

Source :

1) Metastock

Wednesday, 1 June 2016

52-Week High/Low Case Study : Straits Times Index (STI)

Before we wrap up on this topic, we take a final look on another Asian market - Straits Times Index (STI).

52-week Low

52-week High

Source :

1) Metastock

52-week Low

52-week High

Source :

1) Metastock

Sunday, 29 May 2016

52-Week High/Low Case Study : Hang Seng Index (HSI)

During 2008/09 US Subprime Crisis, Hang Seng Index (HSI) touched its 1st 52-week Low of 19,220.28 points on 11 Sep 2008. Thereafter, the market continued its downward and touched a new Low of 16,283.72 points on 18 Sep 2008.

That worked out a huge sum to gain for a short position, with a return of 2,936.56 points.

HSI rebounded to a high of 19,869.02 on 22 Sep 2008 which broke 11 Sep 2008 high of 19,854.82 before it reversed and continued its downtrend - New Lowest of 10,676.29 on 27 Oct 2008 was recorded.

Below is the chart on HSI with 52-week High.

Source :

1) Metastock

That worked out a huge sum to gain for a short position, with a return of 2,936.56 points.

HSI rebounded to a high of 19,869.02 on 22 Sep 2008 which broke 11 Sep 2008 high of 19,854.82 before it reversed and continued its downtrend - New Lowest of 10,676.29 on 27 Oct 2008 was recorded.

Below is the chart on HSI with 52-week High.

Source :

1) Metastock

Wednesday, 25 May 2016

52-Week High Low Case Study : S&P500

We shall take a quick look at S&P500.

52-week High

A new High of 1,150.45 was recorded on 19 Jan 2010 after it achieved its 1st 52-week High on 11 Nov 2009.

That worked out with a gain of +45.08 points (+4.08%).

52-week Low

In this situation, we are not getting a new Low after it touched 1st 52-week Low. Instead, the market rebounded and made a gain of +121.73 (+9.6%).

A similar outcome with DJIA in our last two case studies.

Let us move on to the next market, Asia.

To see how the Asian market price reacts toward this strategy.

Source :

1) Metastock

Labels:

52-Week High,

52-Week Low,

Asia,

Metastock,

S-Trader,

S&P500

Sunday, 22 May 2016

52-Week High Low Case Study : DJIA Part 2

In the last post, we looked at 52-week High on Dow Jones Industrial Average (DJIA) during US Subprime Mortgage Crisis 2008/09.

In 2nd part of DJIA, we shall look at 52-week Low.

DJIA recorded its 1st 52-week Low of 11,634.82 points on 22 Jan 2008. Instead of continuing downtrend, it rebounded to a high of 12,767.74 on 1 Feb 2008.

A gain of +1,132.92 points (+9.74%).

This price action aligned with the alternative strategy which was stated during our introduction of 52-week High Low, as follow:

"Alternatively, another strategy is to sell when price reaches its 52-week high on the assumption that price will recede, or to buy when price reaches its 52-week low in anticipation of a value play."

Take note that the market lost -2,563.28 points (about -18% ) from its high of 14,198.10 points on 11 Oct 2007 to its 1st 52-week Low on 22 Jan 2008.

If we continue forward, we will make an interesting discovery that the 1st 52-week Low was not the lowest point DJIA hit during the crisis. DJIA touched its lowest point of 6,469.95 points on 6 Mar 2009.

In the coming posts, we shall look at S&P500 and some Asia markets indices before we conclude 52-week High/Low strategy.

Source :

1) Metastock

2) www.investopedia.com

In 2nd part of DJIA, we shall look at 52-week Low.

DJIA recorded its 1st 52-week Low of 11,634.82 points on 22 Jan 2008. Instead of continuing downtrend, it rebounded to a high of 12,767.74 on 1 Feb 2008.

A gain of +1,132.92 points (+9.74%).

This price action aligned with the alternative strategy which was stated during our introduction of 52-week High Low, as follow:

"Alternatively, another strategy is to sell when price reaches its 52-week high on the assumption that price will recede, or to buy when price reaches its 52-week low in anticipation of a value play."

Take note that the market lost -2,563.28 points (about -18% ) from its high of 14,198.10 points on 11 Oct 2007 to its 1st 52-week Low on 22 Jan 2008.

If we continue forward, we will make an interesting discovery that the 1st 52-week Low was not the lowest point DJIA hit during the crisis. DJIA touched its lowest point of 6,469.95 points on 6 Mar 2009.

In the coming posts, we shall look at S&P500 and some Asia markets indices before we conclude 52-week High/Low strategy.

Source :

1) Metastock

2) www.investopedia.com

Subscribe to:

Comments (Atom)